All Categories

Featured

Table of Contents

For the majority of people, the most significant issue with the boundless banking principle is that initial hit to very early liquidity caused by the expenses. Although this disadvantage of infinite financial can be reduced significantly with correct policy design, the very first years will certainly always be the most awful years with any kind of Whole Life policy.

That stated, there are certain unlimited banking life insurance policy policies designed primarily for high early money worth (HECV) of over 90% in the first year. Nonetheless, the long-term performance will certainly usually significantly delay the best-performing Infinite Financial life insurance policy policies. Having accessibility to that extra 4 figures in the very first couple of years might come at the expense of 6-figures down the roadway.

You in fact get some significant long-lasting advantages that assist you recoup these early costs and afterwards some. We discover that this prevented very early liquidity trouble with boundless financial is extra mental than anything else when thoroughly discovered. If they absolutely required every cent of the money missing out on from their unlimited financial life insurance coverage plan in the very first few years.

Tag: unlimited banking concept In this episode, I discuss funds with Mary Jo Irmen that instructs the Infinite Banking Principle. This subject might be questionable, yet I intend to get diverse sights on the program and find out concerning different strategies for farm financial monitoring. Some of you might concur and others will not, however Mary Jo brings a really... With the rise of TikTok as an information-sharing platform, economic advice and approaches have actually found a novel method of spreading. One such strategy that has been making the rounds is the limitless banking concept, or IBC for brief, gathering endorsements from celebrities like rap artist Waka Flocka Fire. However, while the approach is presently prominent, its roots trace back to the 1980s when economist Nelson Nash presented it to the globe.

Within these policies, the cash money worth expands based upon a rate set by the insurer. When a substantial cash money value accumulates, policyholders can obtain a money value loan. These finances differ from traditional ones, with life insurance policy serving as collateral, indicating one might lose their coverage if borrowing exceedingly without ample cash value to support the insurance expenses.

And while the attraction of these plans is obvious, there are inherent constraints and threats, necessitating persistent cash money value monitoring. The technique's authenticity isn't black and white. For high-net-worth people or organization proprietors, especially those utilizing strategies like company-owned life insurance policy (COLI), the advantages of tax breaks and substance growth could be appealing.

Bank On Yourself Review Feedback

The allure of unlimited banking does not negate its obstacles: Cost: The fundamental need, a permanent life insurance coverage policy, is pricier than its term equivalents. Qualification: Not everyone receives entire life insurance policy because of extensive underwriting processes that can omit those with certain health or way of living problems. Complexity and threat: The detailed nature of IBC, coupled with its threats, may deter numerous, specifically when easier and much less high-risk alternatives are offered.

Assigning around 10% of your month-to-month earnings to the plan is just not practical for many individuals. Component of what you read below is just a reiteration of what has already been claimed over.

Prior to you get yourself into a situation you're not prepared for, understand the following initially: Although the idea is generally marketed as such, you're not actually taking a lending from yourself. If that were the case, you wouldn't have to settle it. Rather, you're borrowing from the insurance policy company and need to settle it with rate of interest.

Some social media sites posts recommend utilizing cash money value from whole life insurance policy to pay for credit scores card debt. The concept is that when you pay off the loan with rate of interest, the quantity will be returned to your financial investments. That's not exactly how it functions. When you pay back the lending, a part of that rate of interest goes to the insurer.

For the first several years, you'll be paying off the commission. This makes it very tough for your policy to gather worth throughout this time. Unless you can manage to pay a few to numerous hundred bucks for the following years or more, IBC won't work for you.

Cash Value Life Insurance Infinite Banking

Not everybody must count exclusively on themselves for monetary safety and security. If you require life insurance policy, right here are some beneficial pointers to consider: Consider term life insurance policy. These policies give protection throughout years with substantial financial responsibilities, like home loans, trainee loans, or when taking care of children. Ensure to look around for the very best rate.

Copyright (c) 2023, Intercom, Inc. () with Scheduled Font Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Booked Typeface Call "Montserrat".

The Infinite Banking Concept

As a certified public accountant focusing on realty investing, I have actually cleaned shoulders with the "Infinite Financial Principle" (IBC) extra times than I can count. I've also interviewed specialists on the subject. The main draw, apart from the evident life insurance policy advantages, was constantly the idea of accumulating cash value within an irreversible life insurance coverage policy and loaning versus it.

Sure, that makes good sense. Honestly, I constantly thought that cash would certainly be better spent directly on investments rather than funneling it with a life insurance coverage plan Up until I found just how IBC might be integrated with an Irrevocable Life Insurance Policy Depend On (ILIT) to develop generational riches. Let's start with the essentials.

Be Your Own Bank Whole Life Insurance

When you obtain versus your plan's cash value, there's no collection settlement timetable, offering you the liberty to take care of the finance on your terms. The cash money worth continues to grow based on the policy's guarantees and dividends. This setup enables you to access liquidity without interrupting the long-term growth of your policy, gave that the funding and passion are managed sensibly.

As grandchildren are birthed and expand up, the ILIT can buy life insurance policies on their lives. Household participants can take loans from the ILIT, making use of the money value of the plans to money financial investments, begin businesses, or cover significant expenses.

A vital aspect of handling this Family members Bank is the use of the HEMS standard, which represents "Wellness, Education And Learning, Maintenance, or Assistance." This standard is frequently consisted of in trust arrangements to guide the trustee on exactly how they can disperse funds to beneficiaries. By sticking to the HEMS standard, the trust ensures that circulations are produced vital demands and long-term support, protecting the trust's assets while still providing for family participants.

Increased Versatility: Unlike stiff bank car loans, you regulate the settlement terms when borrowing from your very own plan. This allows you to framework payments in such a way that lines up with your service capital. infinite banking real estate. Better Capital: By financing service expenditures via policy lendings, you can potentially release up cash money that would certainly or else be connected up in conventional financing repayments or devices leases

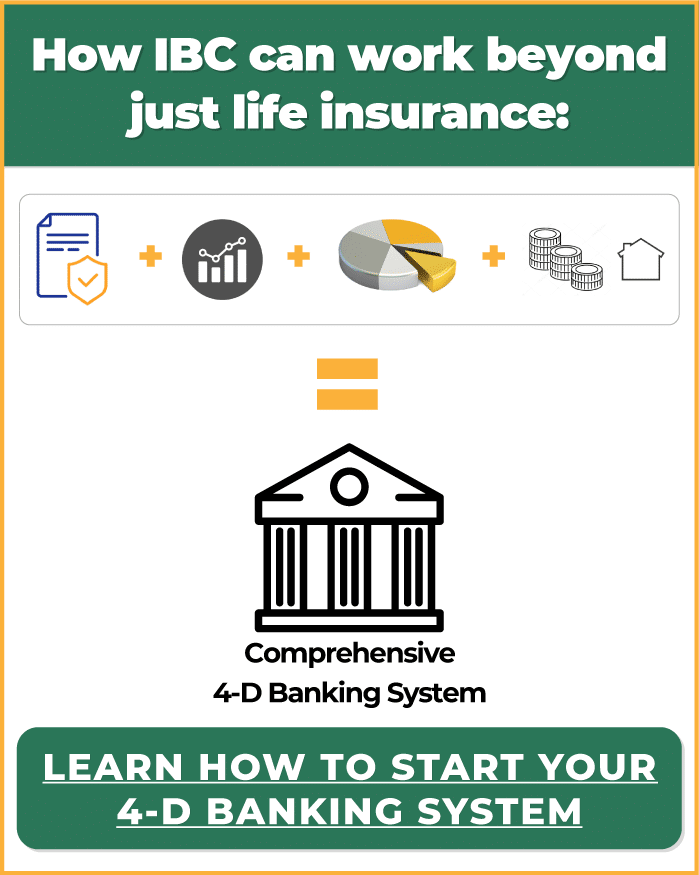

He has the same devices, yet has likewise constructed extra money worth in his policy and obtained tax advantages. Plus, he now has $50,000 available in his plan to utilize for future opportunities or costs., it's crucial to see it as more than just life insurance.

Own Your Own Bank

It's regarding developing a versatile financing system that offers you control and provides multiple advantages. When used purposefully, it can match various other financial investments and business strategies. If you're fascinated by the potential of the Infinite Banking Idea for your organization, here are some steps to take into consideration: Inform Yourself: Dive much deeper right into the idea through respectable books, workshops, or assessments with knowledgeable professionals.

Latest Posts

Infinite Banking Vs Bank On Yourself

Cash Flow Banking Insurance

Infinitebanking Org